radicant

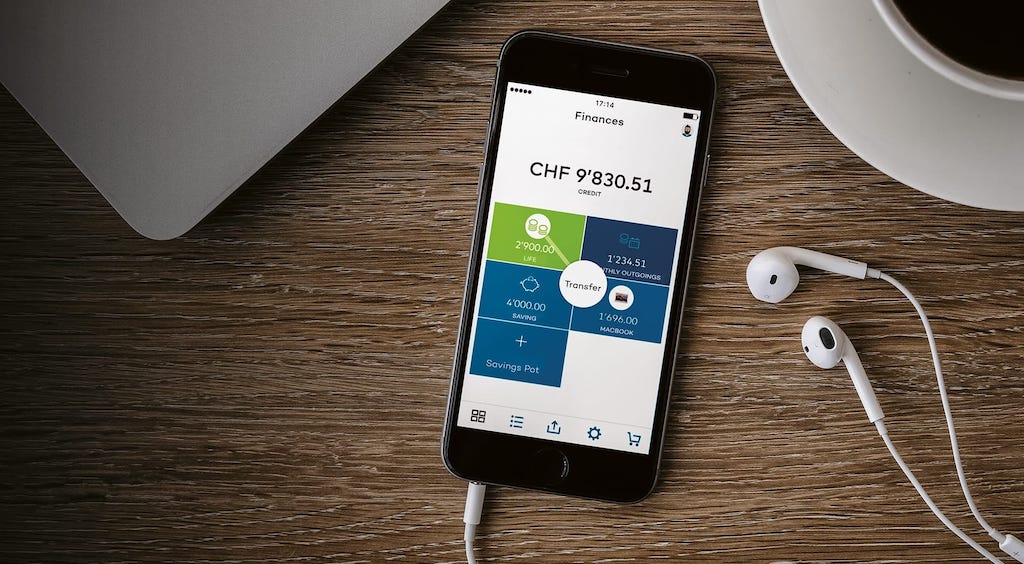

radicant – The first Swiss mobile-only bank with focus on sustainability

Introduction:

In October 2021, radicant Bank, an innovative and sustainability-focused initiative backed by the Baselländische Kantonalbank from Basel Land, Switzerland, approached us with an ambitious vision: to co-create and foster a movement for a sustainable world. Their mission was to align their investment products and services with the United Nations’ 17 Sustainable Development Goals. To turn this visionary project into a reality, radicant Bank sought a partner with deep expertise in digital banking technology and a shared commitment to sustainability. We gladly accepted the challenge.

Project Objectives:

radicant Bank’s ambitious goal necessitated the development of a robust, scalable, and secure digital wealth and banking backend. Our primary challenge was to integrate various third-party services seamlessly. This included Finnova as the core banking system, Salesforce for customer relationship management, Axigo for wealth management, Bloomberg for stock information, and more.

Project Team:

Our dedicated project team was composed of experts well-versed in digital banking technology:

- Project Manager

- Solution Architect

- Business Analysts

- Java Developers

- Scrum Master

- DevOps Specialists

The team had previously collaborated on similar projects, ensuring a seamless and efficient working dynamic from the start.

Infrastructure and Security:

Leveraging Google Cloud’s banking-compliant infrastructure located in Zurich, we built a foundation that prioritized security, reliability, and responsiveness. This approach was vital to meet the stringent standards of Swiss banking while aligning with radicant Bank’s sustainability commitments.

Project Timeline:

By the summer of 2023, radicant Bank was ready to launch its digital wealth and banking backend. Our solution not only supported their day-to-day operations but also provided the scalability and adaptability needed to accommodate future growth and evolving needs.

Conclusion:

The radicant Bank project showcased our unwavering commitment to empowering our clients, regardless of the scale or ambition of their goals. Together with radicant Bank, we demonstrated that financial technology could play a pivotal role not only in enabling banking services but also in making a significant positive contribution to the pursuit of sustainable development goals. This partnership exemplified the potential of technology to drive positive change and create a more sustainable future for all.