Zak

Zak – The first Swiss mobile bank we built for Bank Cler

Introduction:

Our journey with Zak, the revolutionary banking app by Bank Cler, has been an exciting endeavor. As an IT solution provider, we were entrusted with the task of enhancing Zak’s functionality, security, and user experience. This case study showcases our involvement and key achievements in this transformative project.

Background:

Zak, an offering by Bank Cler, stands out from other neobanks. Unlike typical start-ups or fintechs, Zak is backed by an established Swiss bank. This unique blend of innovation and stability provides multiple benefits to our customers, including the security of deposits up to 100,000 CHF through our membership in the deposit insurance scheme.

Project Objectives:

Our overarching goal was to empower Zak users with a feature-rich, user-friendly, and secure banking experience. This was achieved through various IT projects, all guided by the agile Scrum methodology. Leveraging cutting-edge technologies and tools, we aimed to create a comprehensive ecosystem for users.

Key Milestones Achieved:

The Zak App:

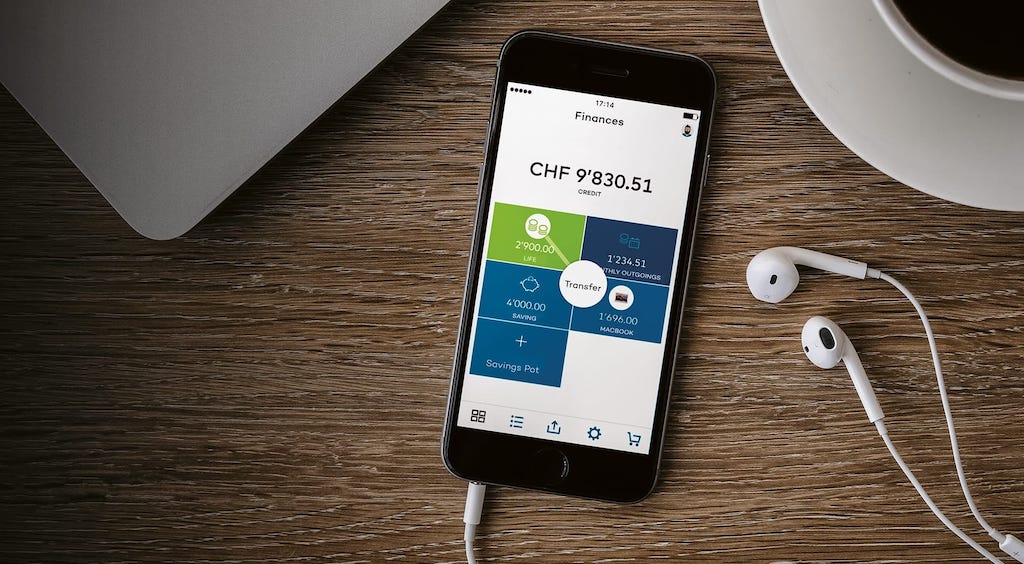

Developed an intuitive and user-friendly mobile app for Zak, offering complete control over finances, including accounts, mobile payments, savings, payments, and financial planning.

Designed for users as young as 15 years old.

Banking and Financial Services:

Integrated with the Avaloq banking core system to provide Zak Bank Account services.

Enabled users to view account details, perform various financial transactions (transfers, standing orders, eBill electronic invoices), and manage their address book.

Introduced the Zak Visa Debit Card, supporting Apple Pay, Google Pay, and Samsung Pay. Users can view all card transactions, set limits, order replacements, and receive PINs through Viseca.

Streamlined user management with comprehensive user-sourcedata (user master data) functionality.

Zak Instant:

Introduced Zak Instant, a peer-to-peer payment solution, allowing users to send and request money from contacts without needing IBANs. Transactions are executed instantly, 24/7.

Budgeting and Expense Tracking:

Implemented monthly expense budgeting with transaction categorization, recurring transaction recognition, and calculation of monthly expenses.

Cornèrcard Integration:

Enabled online top-up of Cornèrcard prepaid cards through Bank Cler Zak accounts.

Provided users with control over card settings and limits, along with easy access to card statements

Push Notification Center:

Introduced a comprehensive notification center for real-time transaction alerts (Apple/Google) and marketing notifications via the Zak Cockpit.

Zak Vorsorge (Retirement Savings):

Launched Zak Vorsorge, including retirement savings accounts, securities management, risk profiling, and digital contract signing using QuaVadis.

Insurance Services:

Integrated with Bâloise for insurance services, including travel baggage insurance with tracking capabilities and cyber insurance coverage.

Onboarding with Video Ident:

Simplified the onboarding process with Video Ident, ensuring rapid, secure, and convenient user identification, including ID verification and biometric validation.

Referral Program:

Implemented the Zak Referral Program, allowing users to invite friends and earn rewards when they join. Generated referral codes, customer imports, and reward statistics were part of this feature.

Savings Pots:

Introduced automatic savings pots to help users save towards specific goals. Users can create shared savings pots, facilitating group savings for activities like shared housing.

Document Repository (Tresor):

Provided a secure document repository for storing account statements, contracts (e.g., retirement savings), bank documents, invoices, and credit card statements.

IBM Chatbot Dr. Watson:

Leveraged IBM’s Chatbot Dr. Watson for AI-powered customer support, responding to user inquiries and offering assistance.

Ecosystem Integration:

Integrated with the Siroop shopping platform for seamless shopping experiences.

Facilitated gift card purchases via OptioPay, offering single sign-on convenience.

Launched Zaktionen, offering users limited-time, attractive deals and discounts.

Zak Cockpit (ITM Development):

Developed the Zak Cockpit, supporting multiple languages (German, Italian, and French).

Managed account and customer-related functions, including account locking/unlocking, consent management (OptIns), push categories, and log reporting.

Introduced a campaign manager and notification configurator for personalized marketing.

Enabled user referrals, including code generation, customer imports, validity settings, and statistics.

Managed data analytics, export generation, and export execution.

Integrated a multilingual CMS system, facilitating banner management, personalized banners, Zaktionen management, news management, and role administration.

Conclusion:

Our collaboration with Bank Cler on the Zak project exemplifies the fusion of innovation and traditional banking. By introducing cutting-edge features and robust security measures, we’ve transformed Zak into a versatile banking app that empowers users of all ages to manage their finances conveniently and securely. This journey reflects our commitment to enhancing the banking experience for all Zak users.